Late payments: tried-and-tested tips to help you deal with it

Late payments are problematic for every business and every entrepreneur. Let's face it - dealing with them can be challenging and time-consuming.

As a company owner, you can't afford to have customers repeatedly failing to pay their invoices - it disrupts your business processes and cash flow. And yet, every business strives for the proper credit report.

Late payments can cause you a lot of stress and anger, but luckily there are ways to take control of them.

In this article, we'll show how to deal with late payments and how to prevent them from occurring in the future.

How to deal with late payments?

Has it happened again that our client received an invoice and hasn't paid it? Instead of sitting around waiting for your customer to finally make a payment, you can take some action.

If you're tired of late payments leading to slowing down your cash flow, we've put together some tips to help you deal with this inconvenient situation.

First of all, don't take the blame

Although chasing late payments is not the most pleasant thing to do, don't beat yourself up with guilt if things don't go your way.

You did your job. You completed the paperwork and sent it to the client. You showed professionalism and did everything on time. It's the client who avoids their responsibilities and is in arrears with the payment - so you shouldn't blame yourself if it's not your fault.

Send the invoice again

Sometimes you don't get paid because you sent the invoice to the wrong person and the email ended up in the wrong mailbox. It can also happen that your client expected you to send the invoice to their accountant or at least CC this person which you haven’t done. Thus they are waiting with getting it paid.

Your client may have also misplaced the invoice and he can’t contact you. These situations can happen to anyone, and in fact, they happen more often than you think.

However, it is up to you to make sure that the payment is made; you are the one who should care most about the cash flow of your business. All you need to do is create the invoice again and resend it to the right recipient. It's better to send the invoice again than never receive the payment.

Cooperate with your accountant

Sometimes, two heads are better than one. That is why it is not worth looking for a solution on your own. Instead of chasing clients for unpaid invoices, you could focus on growing your business.

Contact your accountant and ask for help with late payments. Also, consider inquiring if they can make phone calls to clients for you. Accountants are helpful on many levels, they can be great advisors for your small business, and they will definitely help you with late payment problems as well.

In InvoiceOcean, you can give your accountant access to your account, so that they always have access to your documents and can help you as soon as possible with outstanding payments. Also, you can automate invoice reminders to never have uncomfortable conversations with your clients over unpaid invoices ever again.

Giving access to your accountant in InvoiceOcean

Chase the payments right away

Just like anyone else, customers can make mistakes. They are only human too, they can be busy too and they can forget to pay their invoices.

But you shouldn't turn a blind eye to it. Don’t wait to follow up - you should chase the payment immediately when it becomes overdue. The longer you wait to contact a customer, the longer you will wait to get paid. Sometimes all you need is a payment reminder via e-mail. And if email reminders don't help...

Contact your customer directly

Every business relies on a steady cash flow. When the due date passes, grab the phone and ask your client for the reason why your invoice hasn’t been paid yet. Don't be afraid to demand it – you should be paid for the services rendered.

Try to find a compromise with your client. Discuss how you can work together to improve your relationship and ask directly what you need to do to get paid on time. Maybe the customer is having financial problems themselves and can't make the payment and all you need to do is to wait a few days more? Try to find a solution that works for both parties.

By making a call, the problem will be solved faster than through emails and your intentions will not be misinterpreted. At this stage, you should remain professional so that you get the customer to pay you faster. Be polite but firm at the same time - start with a friendly approach and if that doesn't work...

Impose additional fees

If you've already sent out payment reminders, contacted your customers, and there is still no payment in your bank account, it's time to get serious and impose additional late payment fees.

These don't have to be large amounts - just small percentage numbers, like 1-2%, applied to the total amount will be sufficient. But they can't come as a surprise, they have to be included in payment terms.

No one likes to be penalized and your customers may not be happy with the overpayments imposed. However, if you don't want to lose your money, you need to fight for payments for your services. Get your customers used to the fact that they have to pay extra for not doing their job – late fee encourages customers to pay on time!

Take legal action

Sometimes patience is not enough and you have to take stronger measures. If nothing else works, if the customer still does not respect your rules, taking legal action may be the only option.

However, don't overuse this option, leave it as a last resort for chronic late payers. If, once again, you provide a service and your client fails to make a payment, contact your solicitor and determine the terms of further proceedings.

How to prevent late payments in the future?

The secret to getting paid on time lies in the regularity and consistency in your day-to-day business practices. Issuing invoices alone is not enough if there is no flow of money. So it is worth focusing on streamlining the payment process so the money always arrives on time.

What can you do to avoid late payments?

Set clear payment terms

Establishing clear invoicing rules of your company is something that will avoid misunderstandings in further procedures. Present your payment terms to each new customer and consider including them on each invoice you send to your clients.

Payment terms should include, among other things, due dates (e.g. 30 days for payment), any discounts the client may receive, or information that the client will be charged a late fee for bills paid after their due date.

As an entrepreneur, you need to make sure that these terms are clear and that every customer understands your payment policy. It’s also a good idea to make sure that your clients agree to them in writing - in case of later problems, you can prove who’s right and who’s wrong.

Issue invoices without delays

You can’t demand that others will fulfill their obligations if you don’t fulfill yours first. If you make the bills a priority to you, it will become a priority to others too!

Make a habit of creating invoices immediately. If you create the invoice fresh after arguing it, you won’t make mistakes when filling the document and your client will remember what the invoice/payment is for. This will speed up the payment process considerably.

However, if you do happen to send a late invoice, it's a good idea to send the customer a short message apologizing for the delay. Your client will appreciate the fact that you care about them and respect their time and you will also come as a professional who cares about their business.

Include important data on the invoice

Often your customers can fall behind with payments due to errors on invoices or lack of proper information. And yet clear, professional invoices are key.

Make sure all the necessary information is to be found on the document (due dates, yours and your client’s data, details about services and their prices, the amount due etc). Also, don't forget to add your contact information so that if there is a problem with the payment, your customer can contact you.

Double check that all the data on the invoice is correct. Also, make sure you send the invoices to the right person - it may happen that the buyer would prefer you send them straight to their accountant.

Check out some tips for creating professional invoices.

Provide many payment methods

Payments can cause a lot of problems. It’s a good idea to provide your customers with the ability to choose from various payment methods. There is a chance that by offering more payment options, you can get paid faster. Include information about available payment methods in your terms and conditions so your customers know how they can pay you.

It's worth making available the option to pay by cheque or cash. These options, however, are being used more and more rarely. Switching to online payment options and providing your customers with a link to online transfers or credit card payments, you get a chance of getting paid instantly.

It's also worth connecting a credit card if you are using recurring payments. The money will be collected automatically, and you won't have to worry about late payments.

Provide discounts for fast payers

People love to save their money and will definitely take the chance to pay less. Offering discounts for quick payers can build customer loyalty. It seems like you are not just profit-driven and you care about your clients. By rewarding fast payers, you will make your customers used to paying early.

Customers realize that they will have to pay at some point. Knowing that paying early will get them some additional benefit, they will definitely take advantage of it. It only needs to be a small percentage of the total amount, such as 2%. This will prompt your clients to pay the invoice before the due date.

However, consider whether you can afford to give discounts. Also, be careful not to give the same deal too often and for everyone - discounts will then lose their value. You can't get your customers used to getting a discount everytime for no reason.

Require advance payments or partial payment upfront

Break payments into installments to get paid for each part of a bigger project on time. This is especially useful for long-term projects - clients will get more payment reminders and are more likely to pay in full.

If you want to avoid late payments altogether, require payment before performing any services. It doesn't have to be the full amount, you can offer small prepayments or deposits. If your clients paid a part of the whole amount, they will be motivated to pay all because they don’t want to lose their already invested money. And if they won’t pay the whole amount, remember: getting paid a little bit is better than not getting paid at all.

Generate monthly financial statements

Monitor financial status from previous months. With cash flow reports, you can overview profit and loss statements of your company and forecast the cash flow in your business in the future. As you can see who is paying you and who is in the red, you can consider continuing working with some clients and terminating cooperation with others.

Keep detailed documentation

Keeping records may be time-consuming, but it’s essential if you want to keep control of business transactions..

Human memory is not perfect and as time goes by there is more information to keep track of. By keeping documents, both you and your client have everything written down on paper and you can always go back to it.

If any problems arise and the client tries to make excuses and evade payment, you have written evidence to correct any statement.

Learn more about solutions for getting paid quicker.

What can InvoiceOcean offer regarding late payments?

In InvoiceOcean, you can successfully automate invoice payment reminders and business operations related to faster payments. Here are some advantages of using this software.

1. Create professional invoices and send invoices faster

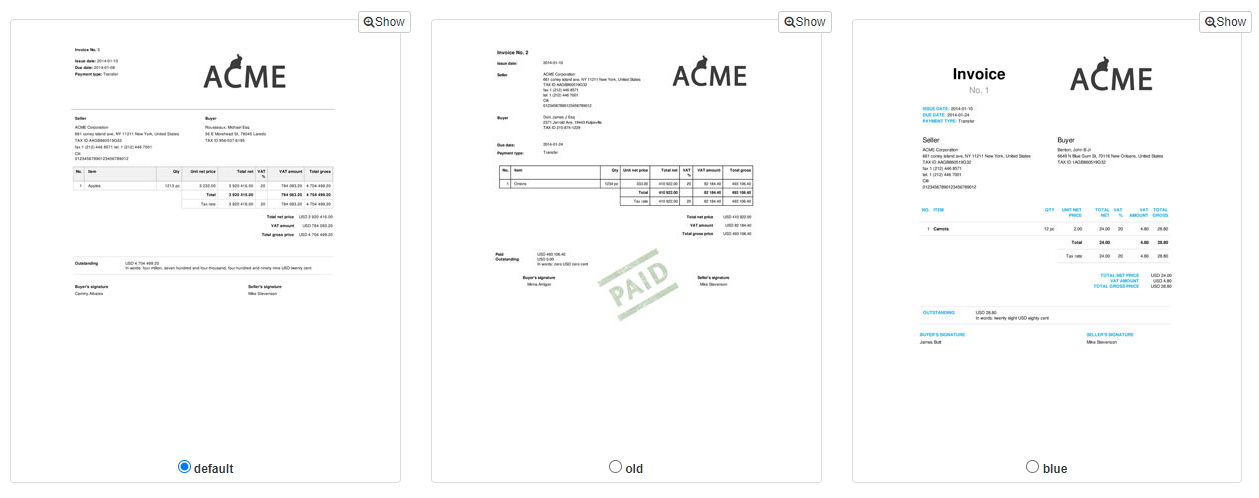

Check out the invoice templates at InvoiceOcean that contain all the information you need to get paid. Choose the one that suits you best and create an invoice in minutes.

Example of an invoice template in InvoiceOcean

2. “Pay Online” button on your invoice

It will take your customers straight to the payment that is convenient for them, so they can make the payment immediately.

"Pay Online" button on the invoice

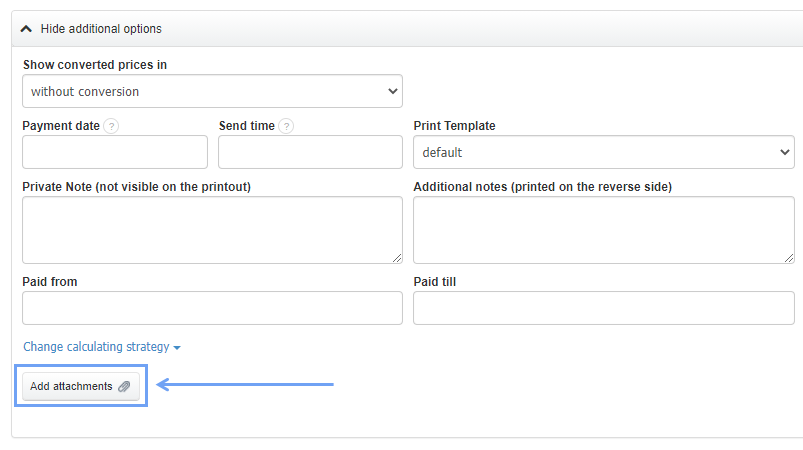

3. Add comments and attachments to invoices

Use this feature to improve communication with your clients. Do you want to add a short thank-you note to your invoicer or send detailed terms and conditions? In our system you can do it with just a few clicks.

Adding attachments to the invoice in InvoiceOcean

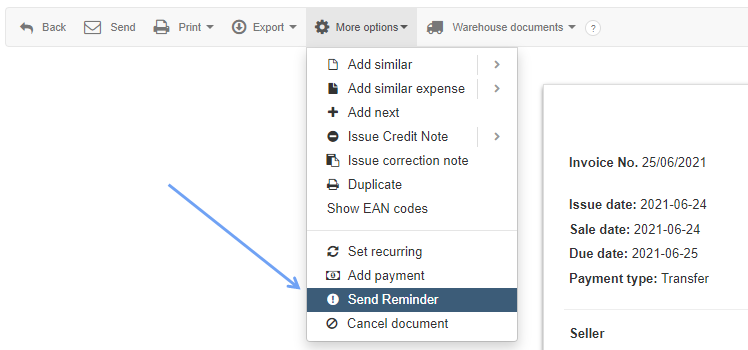

4. Prompt sending of reminder emails

Set up ready-made reminders that will be sent to your customer automatically as soon as the due date passes.

Reminders for payments in InvoiceOcean

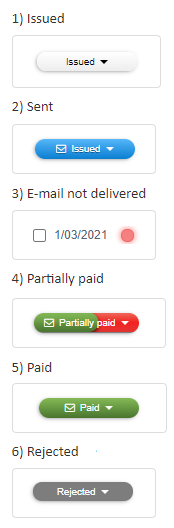

5. Track invoice payment status

By tracking invoice payment status, you can quickly check whether the customer has paid the invoice in part, in full, or has not yet paid at all. This way you will quickly find out whether you already need to notify your customers about late payments.

Invoice payment statuses in InvoiceOcean

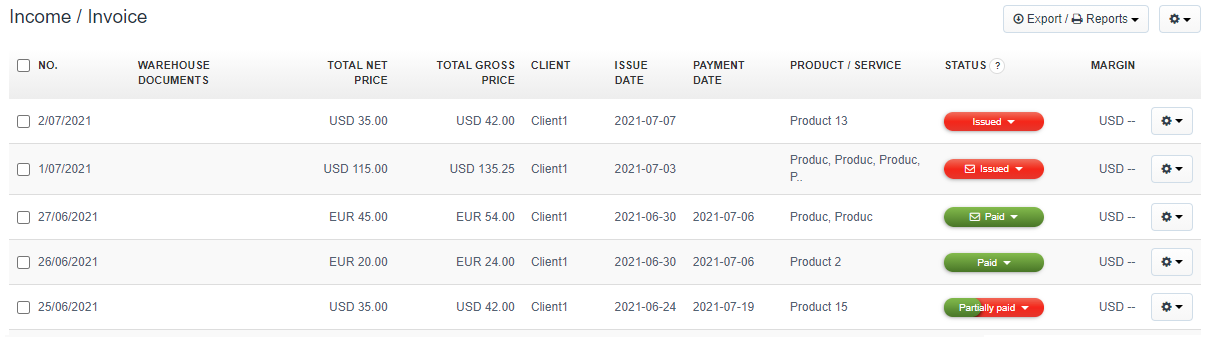

6. Easy invoice management

With InvoiceOcean, all your invoices are stored in one place. You don't have to worry about losing any documents, they are always close at hand and you can always go back to them, easily edit or delete them.

List of invoices in InvoiceOcean

Get paid today!

Hardly anyone likes to ask others to make a payment they owe. This is why many businesses struggle with late payments. However, if you want to keep growing your business, you should understand that asking for late payments is a part of your job. And you should realize that you earned that money and you should receive it.

Collecting payments from your clients on time can have a big impact on your company’s bottom line as a steady and stable cash flow is the basis of any business. As a small business owner, you surely realize how late payments can negatively affect your credit score.

InvoiceOcean is a simple tool to create invoices, managing your company income and expenses. Create invoices with automatic payment reminders with just a few clicks.

Start your free trial

//